401k contribution paycheck calculator

Plan employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck. Increasing your contribution will help you reach your retirement savings goals and it will also help you lower how much you pay in taxes.

Microsoft Apps

If you increase your contribution to 10 you will contribute 10000.

. 401k health insurance HSA etc. A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The Growth Chart and Estimated Future Account Totals box will update each time you select the Calculate or Recalculate. If you consistently find yourself owing. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you want to adjust the size of your paycheck first. The Deferred Compensation Plans Client Service Center is now open for in-person or virtual meetings by appointment only.

Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match. You can also shelter more of your money from taxes by increasing how much you put in a 401k or 403b. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. The annual 401k contribution limit is 20500 for tax year 2022 with an. How You Can Affect Your Kansas Paycheck There are many ways to increase the size of your paycheck starting with asking for a raise or working additional hours granted you are eligible for overtime.

All appointments must be scheduled online in advance. Aged 65 and older. Check with your plan administrator for details.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Under the Before Tax Adjustments section enter any qualifying 401k percentage or HSA contribution amounts that are being withheld from your. Use the paycheck calculator to figure out how much to put.

Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA. You dont have to pay taxes and penalties when you take a 401k loan. 401k HSA etc withheld from your.

For example suppose you had gross pay of 50000 a year and got paid every two weeks. You only pay taxes on contributions and earnings when the money is withdrawn. The annual 401k contribution limits set by the IRS outlined in the chart above are the sum total of contributions to a traditional 401k and a Roth 401k.

Tax rates are dependent on income brackets. Money that you contribute to a 401k or 403b comes out of your paycheck before taxes are applied so. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement. Your 401k plan account might be your best tool for creating a secure retirement. Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make.

CUSTOMER SERVICE CENTER UPDATE. Plus many employers provide matching contributions. Long Term Disability Insurance Life Insurance.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The IRS contribution limit increases along with the general cost-of. The decisions you make when completing your Form.

If you saved that money in a 401k however you would still contribute 417 a month but your paycheck would be reduced by just 333 a month because youve reduced your tax bill by more than 83 each month. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. How You Can Affect Your West Virginia Paycheck.

Payroll 401k and tax calculators. Medicare tax rate is 145 total including employer contribution. If you are 50 or older you can make a catchup contribution of 6500.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. A financial advisor in Wisconsin can help you understand how taxes fit into your overall financial goals. Your household income location filing status and number of personal exemptions.

If you contribute more money to accounts like these your take-home pay will be less but you may still save on taxes. Deductions not withheld. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

If you miss a payment or default on your loan from a 401k it wont impact your credit score. How to use the Contribution Calculator. Employees who typically split paycheck deferrals between traditional and Roth.

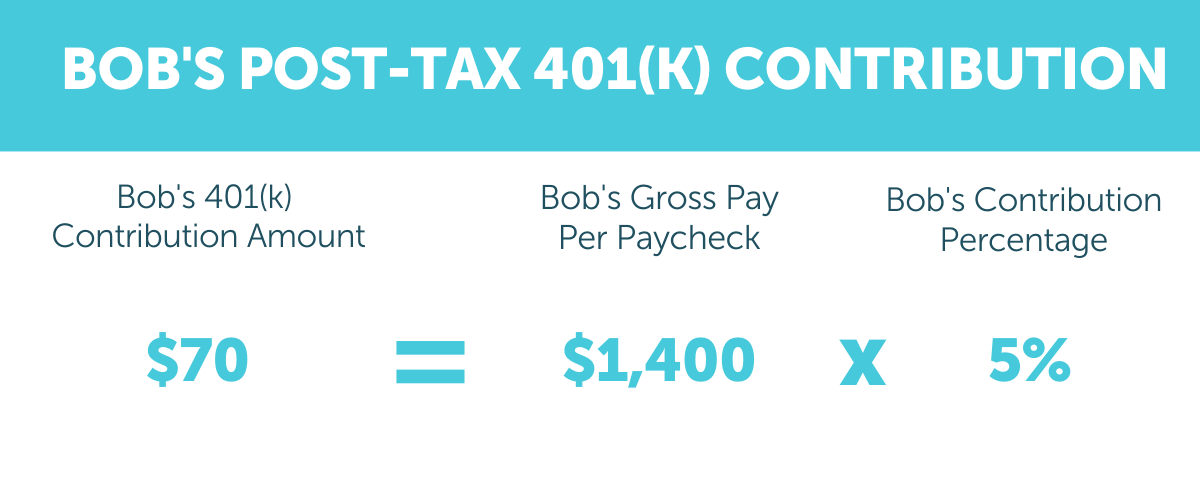

How You Can Affect Your Wisconsin Paycheck. The total 401k contribution from you and your employer would therefore be. If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments.

Enter your wage hours and deductions and this net paycheck calculator will instantly estimate your take-home pay after taxes and deductions 2022 rates. Your household income location filing status and number of personal exemptions. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate.

Youre not required to pay back withdrawals and 401k assets. Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. If you earn 50000 a year for example you would need to save 417 a month before taxes to have 5000 saved at the end of a year.

The interest you pay on the loan goes back into your retirement plan account. We look forward to seeing you soon. How You Can Affect Your Minnesota Paycheck.

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

For 2022 the contribution limit for 401k accounts is 20500 per year or 100 of your compensation whichever is less.

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Plan What Is A 401 K And How Does It Work

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

Solved After Tax Roth 401 K Employee Deductions Company Contributions

How Much Should I Have Saved In My 401k By Age

Three Simple Tips To Improve Your 401 K Match In 2022

Excel 401 K Value Estimation Youtube

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

7 Ways To Invest Your Money In 2022 Investing Novelty Sign Money

7 Ways To Invest Your Money In 2022 Investing Novelty Sign Money

401 K Maximum Employee Contribution Limit 2022 20 500

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

What Is A True Up Matching Contribution

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money